Are Investors Actually Buying Up All the Homes?

Are you trying to buy a home but you feel like you’re up against deep-pocketed Wall Street investors snatching up everything in sight? Many people believe mega investors are driving up prices and buying up all the homes for sale, and that’s making it hard for regular buyers like you to compete.

But here’s the truth. Investor purchases are actually on the decline, and the big players aren’t nearly as active as you might think. Let’s dive into the facts and put this myth to rest.

Most Investors Are Small, Not Mega Investors

A common misconception is that massive institutional investors are dominating the market. In reality, that’s not the case. The Mortgage Reports explains:

“On average, small investors account for around 18% of the market, while mega investors represent only about 1%.”

Most real estate investors are mom-and-pop investors who own just a few properties — not large corporations buying up entire neighborhoods. They’re people like your neighbors who have another home they’re renting out or a vacation getaway.

Investor Home Purchases Are Dropping

But what about the big investors you hear about in the news? Lately, those institutional investors – the ones that make headlines – have pulled back and aren’t buying as many homes.

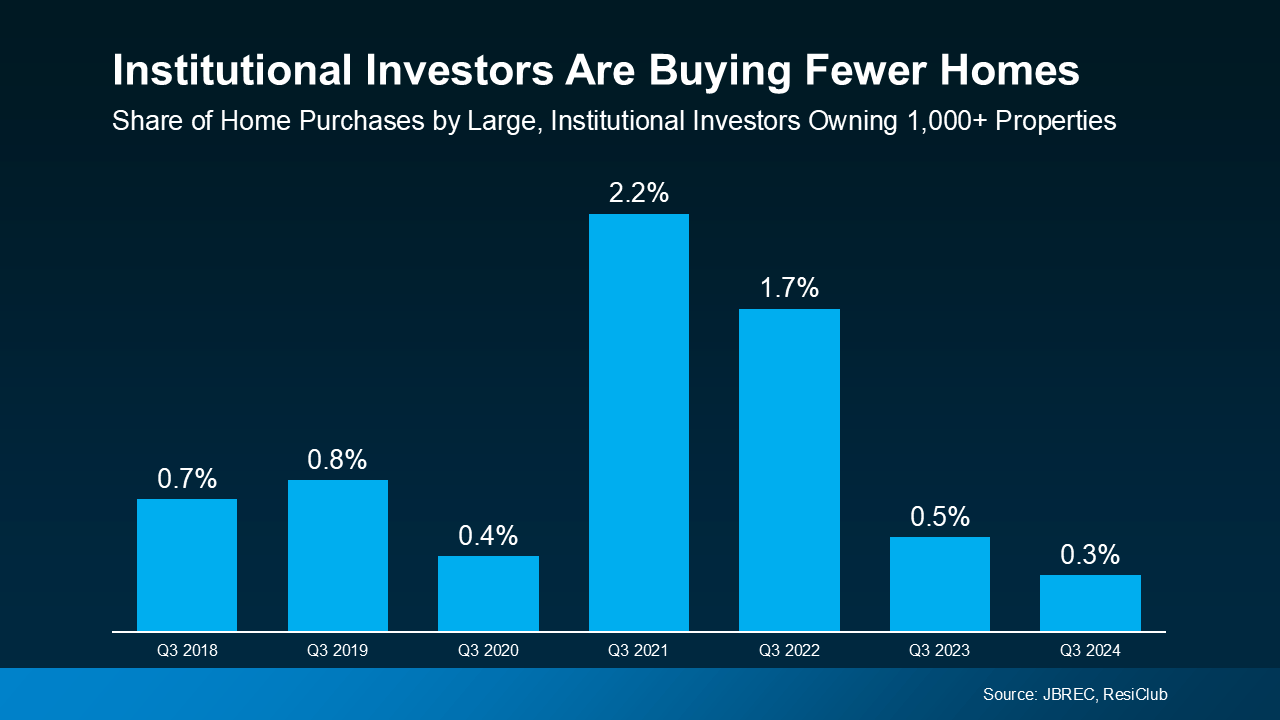

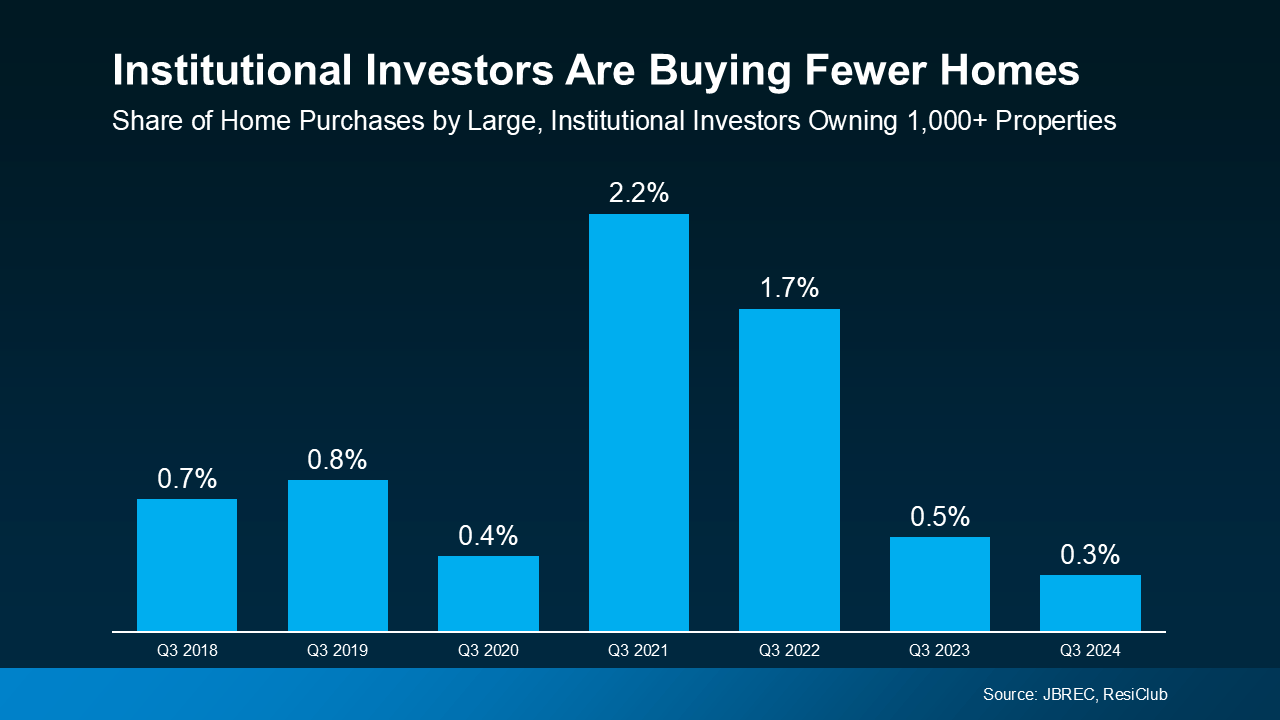

According to John Burns Research and Consulting (JBREC), at their all-time peak in Q2 2022, institutional investors (those owning 1,000+ single-family homes) only made up 2.4% of home sales. And that number has only come down since then. By Q3 2024, that number had fallen to just 0.3% (see graph below):

That’s a major shift, and it means far fewer investors are competing in the market now than just a few years ago.

That’s a major shift, and it means far fewer investors are competing in the market now than just a few years ago.

Investors are clearly more reluctant to buy in today’s market, but why? The answer is largely because higher mortgage rates and home prices have made it less attractive for them.

The idea that Wall Street investors are buying up all the homes and making it impossible for you to compete is a myth. While some investors are still in the market, they’re not nearly as active as they were in past years.

Bottom Line

Big institutional investors aren’t buying up all the homes – if anything they’re buying less than they have been. Let’s connect and talk about what’s happening in our local market. There could be more opportunities than you think.

How does knowing investors are buying fewer homes change the way you see your chances in today’s market?

That’s a major shift, and it means far fewer investors are competing in the market now than just a few years ago.

That’s a major shift, and it means far fewer investors are competing in the market now than just a few years ago.